TDS Strategy Memos

Latest Research from:

Editor’s Corner

By Ed Kilgore

-

July 26: The Obama Coalition Revisited

It’s pretty obvious Kamala Harris’s candidacy changes the 2024 presidential race more than a little, and I wrote at New York about one avenue she has for victory that might have eluded Joe Biden:

During her brief run for the Democratic presidential nomination in 2019, Kamala Harris was widely believed to be emulating Barack Obama’s 2008 campaign strategy. She treated South Carolina, the first primary state with a substantial Black electorate, as the site of her potential breakthrough. But she front-loaded resources into Iowa to prepare for that breakthrough by reassuring Black voters that she could win in the largely white jurisdiction. She had the added advantage of being from the large state of California, where the primary had just been moved up to Super Tuesday (March 3). For a thrilling moment, after her commanding performance in a June 2019 debate, Harris seemed on track to pull off this feat, threatening Joe Biden’s hold on South Carolina in the polls and surging in Iowa. But neither she nor Cory Booker, who also relied on the Obama precedent, could displace Biden as the favorite of Black voters or strike gold in the crowded Iowa field. Out of money and luck, Harris dropped out before voters voted.

Now Kamala Harris is the presumptive Democratic presidential nominee for 2024 without having to navigate any primaries. But she still faces some key strategic decisions. Joe Biden was consistently trailing Donald Trump in the polls in no small part because he was underperforming among young and non-white voters, the very heart of the much-discussed Obama coalition. Can Harris recoup some of these potential losses without sacrificing support elsewhere in the electorate? That is a question she must address at the very beginning of her general-election campaign.

There’s a chance that Harris can inject a bit of the Obama “hope and change” magic into a Democratic ticket that had previously felt like a desperate effort to defend an unpopular administration led by a low-energy incumbent, as Ron Brownstein suggests in The Atlantic:

“Polls have shown that a significant share of Americans doubt the mental capacity of Trump, who has stumbled through his own procession of verbal flubs, memory lapses, and incomprehensible tangents during stump speeches and interviews to relatively little attention in the shadow of Biden’s difficulties. Particularly if Harris picks a younger running mate, she could top a ticket that embodies the generational change that many voters indicated they were yearning for when facing a Trump-Biden rematch …

“In the best-case scenario for this line of thinking, Harris could regain ground among the younger voters and Black and Hispanic voters who have drifted away from Biden since 2020. At the same time, she could further expand Democrats’ already solid margins among college-educated women who support abortion rights.”

Team Trump seems to believe it can offset these potential gains by depicting Harris as a “California radical” and a symbol of diversity who might alienate the older white voters with whom Biden had some residual strength. Obama overcame similar race-saturated appeals in 2008, but he had a lot of help from a financial collapse and an unpopular war presided over by the party of his opponent.

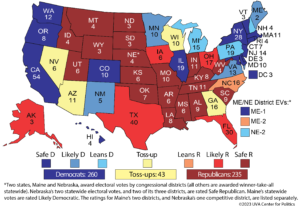

Following Obama’s path has major strategic implications in terms of the battleground map. Any significant improvement over Biden’s performance among Black, Latino, and under-30 voters might put Arizona, Nevada, Georgia, and North Carolina — very nearly conceded to Trump in recent weeks — back into play. But erosion of Biden’s support among older and/or non-college-educated white voters could create potholes in his narrow Rust Belt path to victory in Michigan, Pennsylvania, and Wisconsin.

These strategic choices could definitely affect Harris’s choice of a running-mate, not just in terms of potentially picking a veep from a battleground state, but as a way of amplifying the shift produced by Biden’s withdrawal. Brownstein even thinks Harris might consider following Bill Clinton’s 1992 example of doubling down on her own strengths:

“The other option that energizes many Democrats would be for Harris to take the bold, historic option of selecting another woman: Whitmer. That would be a greater gamble, but a possible model would be 1992, when Bill Clinton chose Al Gore as his running mate; Gore was, like him, a centrist Baby Boomer southerner—rather than an older D.C. hand. ‘I love Josh Shapiro and I think he would be a great VP candidate, but I would double down’ with Whitmer, [Democratci consultant Mike] Mikus told me. ‘I don’t think you have to go with a moderate white guy. I think you can be bold [with a pick] that electrifies your base.’ I heard similar views from several consultants.”

Whitmer’s expressed disinterest in the veepstakes may take that particular option off the table, but the broader point remains: Harris does not have to — and may not be able to — simply adopt Biden’s strategy and tweak it slightly. She may be able to contemplate gains in the electorate that were unimaginable for an 81-year-old white male incumbent. But the strategic opportunity to follow Obama’s path to the White House will first depend on Harris’s ability to refocus persuadable voters on Trump’s shaky record, bad character, and extremist agenda. Biden could not do that after the debate debacle of June 27. His successor must begin taking the battle to the former president right now.

Good riddance to the distraction of the race based affirmative action debate.

Class and geography based admissions could achieve much better results.

Affirmative action based on race is an inter elites controversy, part of the (mostly useless) cultural wars.

Blacks, Hispanics and Asians don’t support race based affirmative action and those that do don’t obsess about it.

The left still has a general mess with many of the not so progressive views of working class “people of color”.

https://www.nytimes.com/2023/06/11/us/supreme-court-affirmative-action.html?fbclid=IwAR3X67kFr2D2a49YlvaD9tiRHhzlHVFwtc6tQklRZn_l6sXRmpW2CJXQkSY

If Democrats wanted to get rid of legacy admissions they could have done so one of the many times they have controlled Congress or Department of Education regulations.

Trying to ban legacy admissions via the courts is dangerous.

Legacy admissions are about class. If they result in fewer minority admissions it is only due to an indirect effect.

But it would be rich for Democrats to achieve the precedent of banning class based affirmative action via jurisprudence that would set the stage for also banning class based affirmative action in favour of poorer students.

Ban legacy admissions and next the right will ban privileges for Pell Grant and scholarship admissions.

Color blindness is required by the Constitution and entirely consistent with traditional left wing values, as explained by MLK and other civil rights era leaders.

Legacy admissions should be banned, but they are not the correct tit for tat neither in political discourse nor in judicial caselaw.

Class blindness has not traditionally been seen as required by the Constitution and civil rights law.

It is moronic that Democrats would make the analogy. The fact that they do just shows just how overtaken by elites the party is.

https://www.msnbc.com/rachel-maddow-show/maddowblog/high-court-ruling-dems-take-aim-legacy-admissions-rcna91983

“White Democrats (75%) are also significantly more likely than nonwhite Democrats (40%) to support broadening how gender is taught.

Clear majorities of both whites (68%) and people of color (57%) say transgender and sexual identity issues should be given less attention.

Similarly, both groups support limiting how gender identity is taught in schools (59% white and 52% people of color).

As may be expected, white Republicans (93%) are much more likely than white Democrats (20%) to want to limit how gender identity is taught in schools.”

https://www.monmouth.edu/polling-institute/reports/monmouthpoll_us_062823/?fbclid=IwAR0rBgVPOI7ntaIh_C3SSfoFQS3rqvaLchPYdRwQdqeuqHDD2MnGoMmaGl0

“A majority of Hispanic voters (58%), young voters ages 18 to 34 (57%), Democrats who backed progressive Sens. Elizabeth Warren and Bernie Sanders in the 2020 Democratic primary (55%) and Black voters (52%) say they’re open to considering a third-party or independent presidential candidate in a Biden-Trump rematch.”

https://www.nbcnews.com/politics/2024-election/dems-republicans-are-open-third-party-presidential-candidate-rcna91368?fbclid=IwAR2m8IoPEE8F7kcvlsZG0BL2wm6rl9flCkI9e0x598jwRrP-PqM4n2fMUjE

“Our findings suggest that work stress generally increased from 1995 to 2015, and that the increase was mostly driven by psychological demands.

People working in lower-skilled occupations had generally higher levels of job strain and effort-reward imbalance, as well as they tend to have a steeper increase in job strain than people working in higher-skilled occupations.

Most of the change occurred from 1995 to 2005.”

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8032584/